ULIP is a hybrid financial product that combines the benefits of life insurance and investment. And it also provides flexibility, tax benefits, wealth creation, and partial withdrawal opportunities as well. Check out this article to know the benefits of ULIP, how ULIP works, & term insurance vs ULIP differences.

ULIP Insurance: Overview

Unit Linked Insurance Plans, popularly known as ULIPs. ULIP combines two components, which are insurance and investment. A portion of the premium paid by the policyholder goes towards life coverage, while the remaining amount is invested in various funds of their choice.

The insurance component of ULIPs provides financial protection to the policyholder’s family in case of their untimely demise. In such a scenario, the beneficiaries receive the sum assured, which is the minimum amount guaranteed by the policy. The investment component, on the other hand, offers the policyholder the opportunity to grow their wealth over time by investing in various funds.

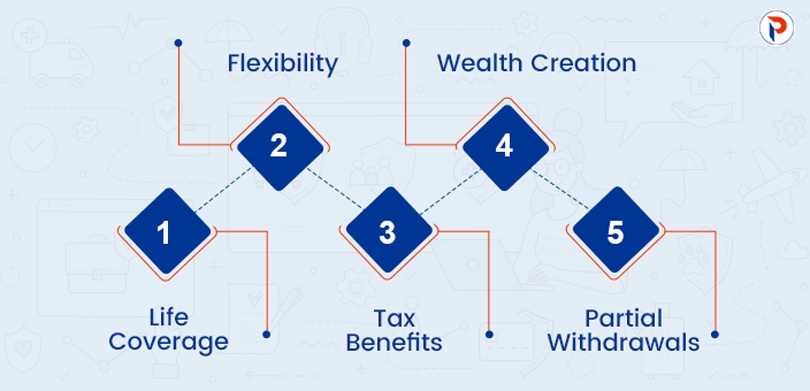

Benefits of ULIP

Following are the benefits of ULIP Insurance in the future.

-

Life Coverage

ULIP provides life coverage, which ensures that the policyholder’s family is financially secure in case of their untimely demise. The sum assured provides a safety net for the beneficiaries and can help them meet their financial obligations.

-

Flexibility

ULIP offers flexibility in terms of investment and premium payments. The policyholder can choose the type of fund they wish to invest in, depending on their financial goals and risk appetite. Additionally, ULIPs offer flexibility in terms of premium payments. The policyholder can choose to pay premiums monthly, quarterly, or annually, depending on their convenience.

-

Tax Benefits

ULIP offers tax benefits under Section 80C of the Income Tax Act. The premium paid towards the policy is eligible for a tax deduction up to a maximum of Rs. 1.5 lakhs per annum. Additionally, the maturity amount and death benefit received by the policyholder’s beneficiaries are tax-free under Section 10(10D) of the Income Tax Act.

-

Wealth Creation

ULIP offers the opportunity to grow wealth over time by investing in various funds. The policyholder can choose to invest in equity, debt or balanced funds, depending on their financial goals and risk appetite.

The returns on ULIPs are market-linked, which means that they are subject to market fluctuations. However, over the long term, ULIPs have the potential to generate higher returns than traditional insurance policies.

-

Partial withdrawals

ULIP offers the facility of partial withdrawals, which means that the policyholder can withdraw a portion of the accumulated corpus in case of any financial emergency. The policyholder can make partial withdrawals after a lock-in period of 5 years, which ensures that the funds remain invested for a sufficient period to generate significant returns.

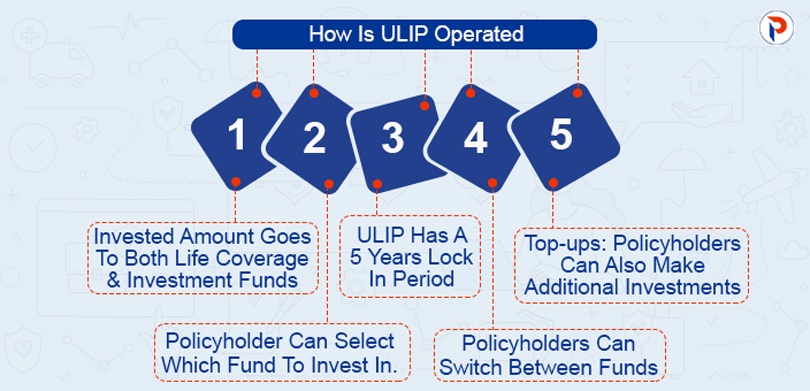

How Does ULIP Work?

ULIP works in a simple and straightforward manner. When a policyholder invests in a ULIP, a portion of the premium paid goes towards the life coverage, while the remaining amount is invested in various funds.

The policyholder can choose the type of fund they wish to invest in, depending on their financial goals and risk appetite. The funds are managed by professional fund managers, who invest the money in various stocks and bonds to generate returns.

The returns on ULIPs are market-linked, which means that they are subject to market fluctuations. The policyholder can monitor the performance of their funds through regular updates provided by the insurance company.

Additionally, ULIPs have a lock-in period, which means that the policyholder cannot withdraw the funds for a certain period. The lock-in period for ULIPs is 5 years, after which the policyholder can make partial withdrawals. However, it is advisable to stay invested in ULIPs for a longer period to generate significant returns.

ULIPs also offer the facility of switching between funds. The policyholder can switch between funds depending on their investment goals and market conditions. However, most insurance companies allow a limited number of free switches, after which a nominal fee may be charged.

ULIPs also offer the facility of top-ups. The policyholder can make additional investments in their ULIPs, known as top-ups. Top-ups are an excellent way to increase the corpus of the policy and generate higher returns over time.

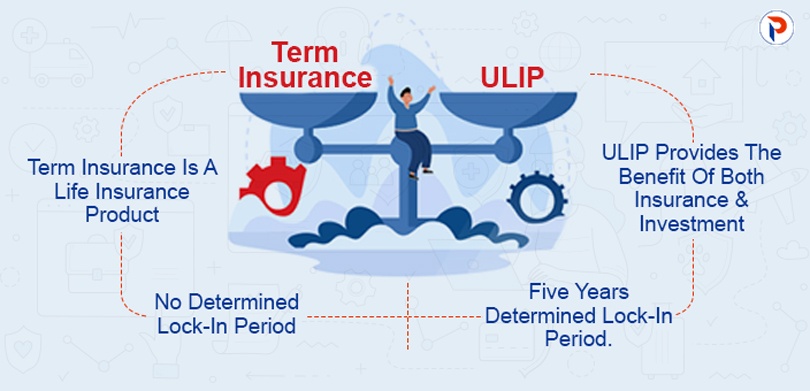

Differences: Term Insurance Vs ULIP

| Term Insurance | Unit Linked Insurance Plan (ULIP) |

| Term insurance is a life insurance product | ULIP provides the benefit of both insurance & investment |

| No determined lock-in period | Five years determined lock-in period. |

| Compared to other insurance plans, term insurance premiums are quite low. | There are various charges included in ULIP. So, the premium can be high. |

| If the policyholder died then the beneficiaries will be able to receive an assured amount. | If the policyholder died then the sum assured amount & return yield over their investment will be provided to beneficiaries. |

| Policy tenure will be based on the term that you choose while buying the policy. | Will have to wait for at least 5 years lock-in period to surrender the policy or want to make partial withdrawals |

FAQs

| What are the significant advantages of ULIP?

Life coverage, flexibility, tax benefits, wealth creation, & partial withdrawals are the significant advantages of ULIP. |

| What is the main difference between term insurance vs ULIP?

Term insurance is a life insurance product. Whereas, ULIP provides the benefit of both insurance & investment. And this is the main difference between these both. |

| Will you have an opportunity to choose the fund type in ULIP?

The policyholder has the opportunity to select the fund type they wish to invest in, depending on their financial goals and risk appetite. |

| What is the lock-in period in ULIP?

ULIP has a five years determined lock-in period. |