A travel insurance policy ensures that you travel the world, stress-free. Imagine losing your passport or needing medical attention abroad. Trying to solve these problems on your own, where you don’t know the locality can get difficult. This is where getting travel insurance would help as you would be assured of financial help in case of a crisis. So, read the article to know what is travel insurance, its types, coverage, and costs involved in the process.

What is Travel Insurance?

Travel insurance provides financial assistance in case you suffer a crisis or an emergency while travelling.

A travel insurance policy could reimburse you for cancelled or delayed flights, lost luggage, loss of documentation, medical emergency, and such.

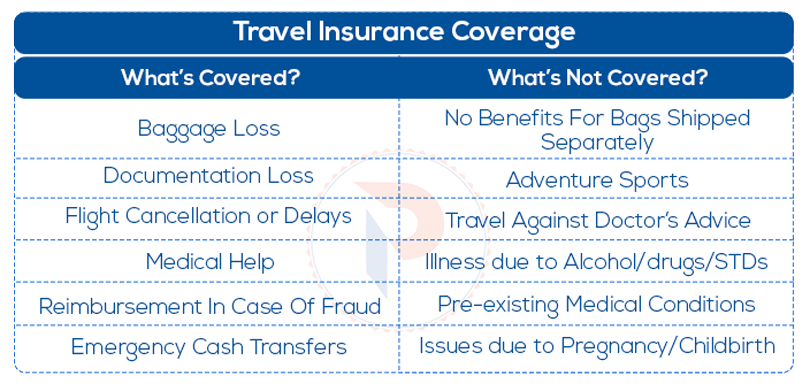

What is Covered by Travel Insurance?

In general, a travel insurance policy would cover the following scenarios –

1. Loss of Baggage

2. Loss of Passport/Documentation

3. Flight Cancellation/Delays

4. Medical Aid

5. Fraud Reimbursement

6. Other Journey Hassles

1. Loss of Baggage

- The policy will compensate for the loss of your belongings up to the decided sum.

- Some policies also compensate you for delayed baggage, in case you have to buy any essentials while you wait for it.

2. Loss of Passport/ Documentation

- In case you lose important documents or your passport, the travel insurance agency will cover the costs of acquiring the new ones.

3. Flight Cancellation/Delays

- A travel insurance policy will refund you the amount if you cancel your flights for personal reasons.

- It also covers flight cancellation by the airline in case of a natural disaster or if it is the airline’s fault.

- In case of flight delays, travel insurance covers your additional expenses such as hotel accommodation and food costs.

- You also get reimbursed for missed departures as well.

4. Medical Aid

- A travel insurance policy covers your expenses if you fall sick or suffer an accident during your trip.

- It will also cover hospitalisation charges and emergency evacuation in case you need to be transferred to a nearby hospital.

- The policy also covers the expenses involved in transferring you back to your city or country for further medical attention.

- Most travel insurance policies today cover Covid-19 as well. Right from cancelling your trip midway to extending it in case a lockdown is imposed, insurers today take care of these expenses for you.

5. Fraud Reimbursement

- Travel insurance policies also reimburse you the amount, in case you lose money because of a stolen debit card.

- Note that insurers will take care of these amounts only for a certain number of hours from when you first reported the incident.

6. Other Journey Hassles

- In case of emergencies, insurance agencies provide you with immediate cash transfers.

- Bounced hotel or airline bookings is a common issue, and your insurance policy refunds these amounts as well.

- For any reason you may need to cancel your trip, the insurer may provide trip cancellation or curtailment up to a certain amount.

What is not Covered in a Travel Insurance Policy?

Below are a few common exclusions in a travel insurance policy, where you may not get your claims met by the travel insurance agency –

- You cannot claim baggage loss if you had it shipped separately.

- If you have any pre-existing medical condition

- Adventure sports and activities.

- Travelling against your doctor’s advice

- Any health issues that arise from pregnancy or childbirth

- Illness or injuries due to consumption of alcohol/drugs, sexually transmitted diseases or a mental disorder.

Travel Insurance – Coverage Highlights

What are the Types of Travel Insurance?

1. Single Trip Insurance Policy

A one-time payment for a single trip, this type of insurance policy covers baggage loss, damage, and medical expenses for the duration of your trip. It is quite useful if you travel rarely.

2. Multi Trip Insurance Policy

A multi-trip insurance policy is beneficial if you are accustomed to travelling frequently, especially for business trips.

There are also options to opt for an annual multi-trip travel insurance, as it offers coverage for your travel throughout the year.

Getting an annual multi-trip travel insurance policy also saves you the hassle of getting one separately for each trip. You can also club your policy easily with add-ons as well.

3. Student Travel Insurance

A travel insurance specially designed for abroad education, the policy is perfect for students. Here’s all that a student travel insurance policy covers –

- It covers financial aid due to accidents/illness while you’re abroad.

- If you or your family member has been hospitalised for several days, most policies will cover the cost of visiting your family.

- Student travel insurance will cover your unused tuition fee, if you decide to discontinue your education due to medical reasons.

4. Group Insurance Policy

Group insurance policies are meant for a number of travellers, as one would not have to buy insurance separately for each person while travelling in a group.

Such insurance packages usually come with a host of benefits. It also helps travellers save more on premiums while still availing all the advantages of the travel insurance policy.

5. International Travel Insurance

Unlike domestic travel, international travel is an expensive affair. Moreover, any problem you encounter during your trip could be a bigger hassle when you’re overseas.

This is why it’s important to buy international travel insurance to secure yourself from mishaps or scams.

So, What is International Travel Insurance?

Like any other travel insurance, international travel insurance provides you with financial aid when you suffer a crisis during your trip. Such policies provide a range of benefits such as –

- Baggage loss claims

- Compensation for flight cancellations/delays

- Medical aid along with automatic extensions

- Distress allowance in case of plane hijacks

- Accident & personal liability covers

Note – Overseas travel insurance is mandatory when you apply for a Schengen visa to Europe, while it is not compulsory to get one while travelling to the USA, Canada, and more.

What is IRCTC Travel Insurance & Its Benefits?

When it comes to train travel, travel insurance is often neglected. But, the fact is that train accidents are a common occurrence in India and it is always a good idea to stay safeguarded in this case.

Moreover, train insurance in India is easily offered by IRCTC. Offered with every trip, it costs only 0.35 rupees for a sum insured of Rs. 10 lakhs in case of death.

IRCTC Travel Insurance Plan Coverage

Here are the coverage benefits of the IRCTC Travel Insurance Plan –

| Situation | IRCTC Travel Insurance Coverage |

| Death | Rs. 10 Lakhs |

| Permanent Disability | Rs. 10 Lakhs |

| Permanent Partial Disability | Rs. 7.5 Lakhs |

| Hospitalisation for Injuries | Rs. 2 Lakhs |

| Transportation of Mortal Remains | Rs. 10,000 |

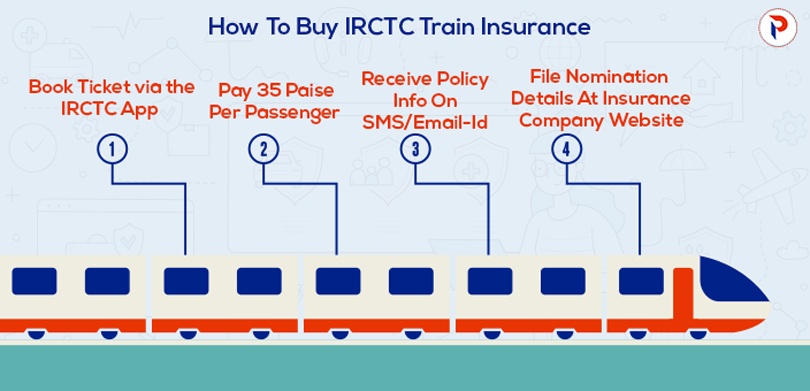

How To Get The IRCTC Travel Insurance Plan?

Below are the steps to get the IRCTC Travel Insurance Plan –

Step 1 – Book Your Ticket via the IRCTC NGet App (Next Generation E-ticketing System)

Step 2 – Pay The Premium of 35 Paise Per Passenger

Step 3 – You will receive the policy information along with the link to file nomination details on SMS/Registered E-mail ID

Step 4 – After your ticket is booked, file the nomination details again at the insurance company website

Note – As per the IRCTC terms and conditions, foreigners or kids below 5 years of age are not eligible for the IRCTC travel insurance.

What is the Cost of Travel Insurance?

The cost of your travel insurance could be anywhere between 5 to 10% of your trip costs. For instance, if your trip cost is 1 lakh, your insurance could cost you anywhere between Rs. 5000 to 10,000.

Key points to remember for International Travel Insurance Costs –

- If you’re travelling to any European country, you should be insured for a minimum cover of 50,000 USD dollars

- International Travel Insurance usually plans start from 700 Rupees for 20,000 USD dollars and 1200/- Rupees for a cover of 50,000 USD dollars

FAQs

| What is the best company for travel insurance?

Some of the top companies that offer travel insurance plans are ICICI Lombard, HDFC Ergo, TataAIG, Royal Sundaram, & Bajaj Allianz. |

| Why do I need travel insurance?

Baggage loss claims, misplacement of passport, flight delays, and travel scams are common all over the world. Moreover, remember that medical expenses cost higher outside India. Travel insurance covers all these contingencies and provides travellers with financial aid when crisis strikes during the trip. |

| Can I go without travel insurance?

Travel insurance is not mandatory for most countries, but it is quite important to get one if you are travelling in remote areas or wish to stay secure from the various risks involved. |

| Does travel insurance cover airline cancellations?

Yes. Travel insurance covers airline cancellations. |